Toronto, Ontario –November 20, 2024 – Canadian Gold Corp. (TSXV: CGC) (“Canadian Gold” or the “Company”) announces a non-brokered private placement offering of up to $750,000, by the issuance of flow-through common shares at a price of $0.19 per share.

The proceeds raised from the issuance of flow-through common shares will be used to incur eligible Canadian exploration expenditures at the Company’s Tartan Mine near Flin Flon, Manitoba, to advance its Phase 4 exploration program.

Phase 4 Exploration Program

The Company’s Phase 4 exploration program will look to build upon the success of the previous phases, targeting four key areas:

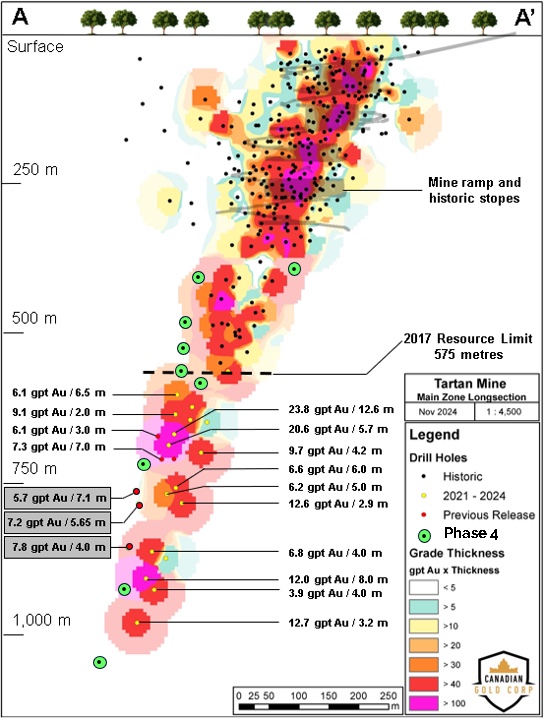

- Western extension and infill between 375 and 600 metres: To advance the current resource estimate at the Main Zone, six holes are planned to test the western flank and infill large gaps between drill holes at depths ranging from 375 to 600 metres below surface. The objective of these holes will be to increase the number of ounces per vertical metre, convert ounces to the measured and indicated categories, expand the inferred resource to the west (Fig. 1).

- Continue to define the western flank of the Main Zone below the previous resource estimate: Drilling during Phase 3 successfully intersected high-grade gold along this western flank from 700 to 850 metres below surface. Drill assay results from Phase 3 included 7.3 gpt gold over 7.0 metres, 7.2 gpt gold over 5.65 metres and 7.8 gpt gold over 4.0 metres (Fig. 1).

- Deeper exploration with limited drilling: To date, limited deep drilling at the Tartan Mine’s Main Zone has successfully intersected some of the best results in the project’s history, 4.2 gpt gold over 53.7 metres including 12.0 gpt over 8.0 metres. Thus far, Canadian Gold has not been able to effectively follow-up on this result due to various technical reasons, which the Company believes has been corrected. Two deep holes are planned at the Main Zone (Fig. 1).

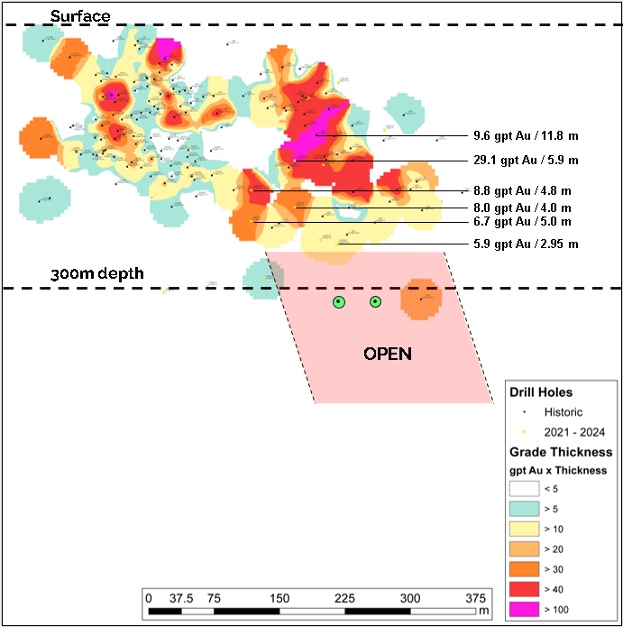

- Extension of the South Zone: Two holes are planned for the South Zone below 300 metres with the objective of extending mineralization at depth (Fig. 2).

The offering is subject to receipt of approval by the TSX Venture Exchange and any other regulators having jurisdiction. It is intended that the flow-through shares will qualify as ‘flow through shares’ within the meaning of the Income Tax Act (Canada) and will be offered to all qualified purchasers resident of any Canadian province in reliance upon exemptions from the prospectus and registration requirements of applicable securities legislation. The securities issued upon the closing of the offering will be subject to a four month hold period from the date of issue, including any other re-sale restrictions imposed by applicable securities regulatory authorities. Insiders of Canadian Gold may, subject to applicable regulations, participate in the offering.

Finders’ fees equal to 6% of the gross proceeds raised may be paid to eligible finders or other third parties, in connection with this offering.

For Further Information, Please Contact:

Michael Swistun, CFA

President & CEO

Canadian Gold Corp.

(204) 232-1373

info@canadiangoldcorp.com

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the Company, and a Qualified Person as defined under National Instrument 43-101.

About Canadian Gold Corp.

Canadian Gold Corp. is a Toronto-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada’s largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). The Company is 35% owned by Robert McEwen, who was the founder and CEO of Goldcorp and is Chairman and CEO of McEwen Mining.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of the Company contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

Figure 1. Tartan Mine – Main Zone Long Section illustrating Phase 4 planned drilling locations.

Figure 2. Tartan Mine – South Zone Long Section illustrating Phase 4 planned drilling locations.