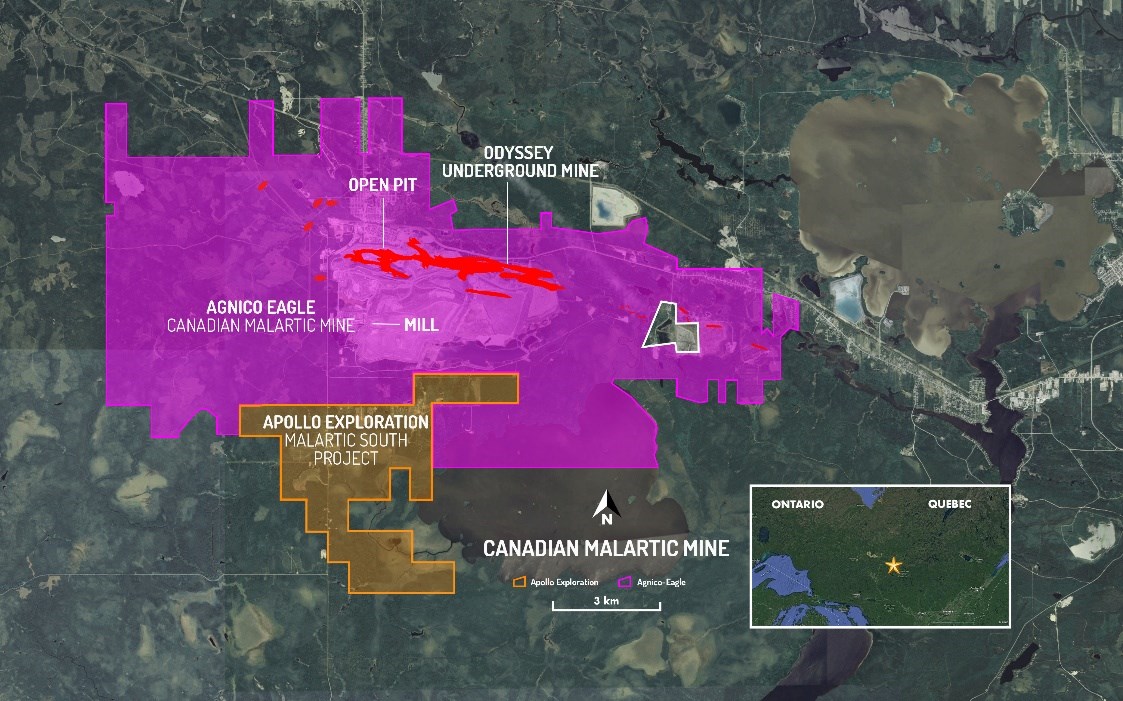

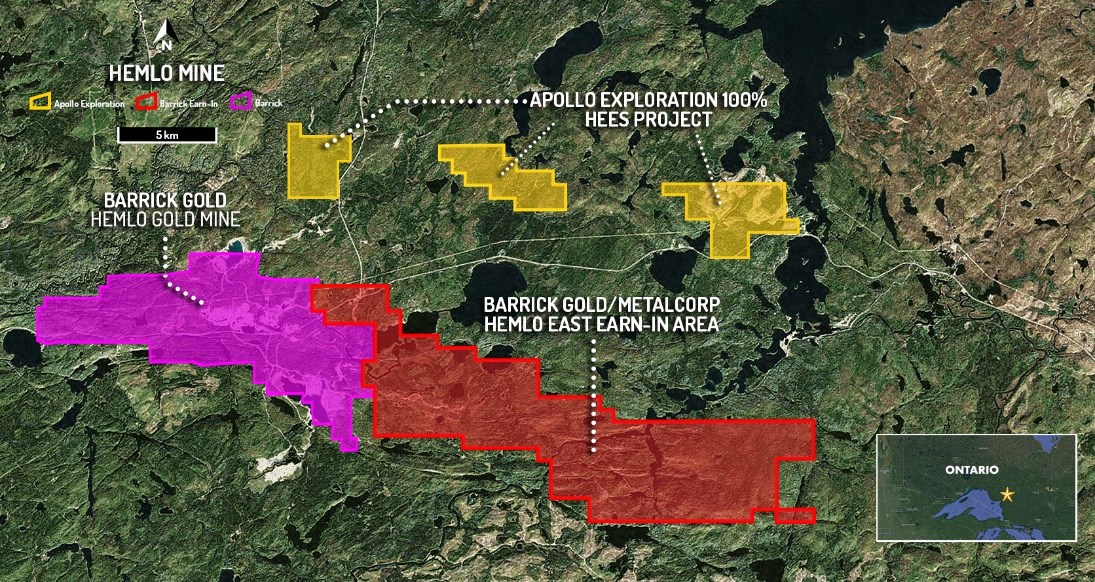

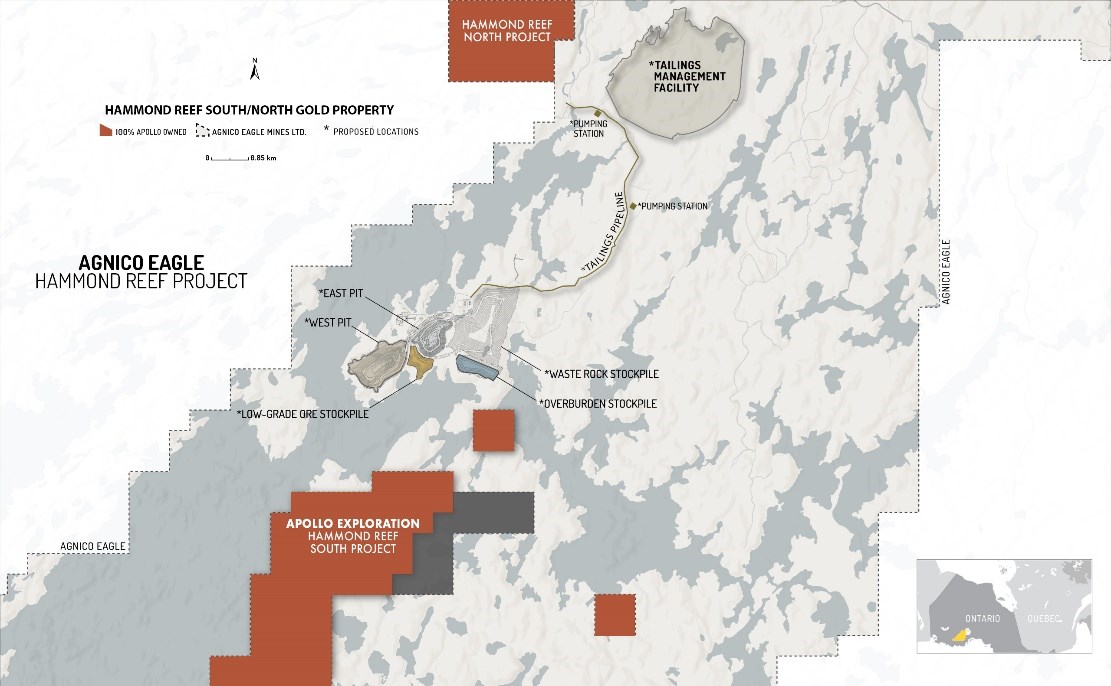

Toronto, Ontario – February 6, 2023 – Satori Resources Inc. (TSXV: BUD) (“Satori” or the “Company”) is pleased to announce that the founder and former Goldcorp Inc. Chairman and CEO, Rob McEwen, will become Satori’s largest shareholder owning 37.6% of the Company with the objective of expanding the high-grade gold zones at the past producing Tartan Lake Gold Mine in Flin Flon, Manitoba. Satori is proposing to acquire Rob McEwen’s 100% owned private exploration company, Apollo Exploration Inc. (“Apollo”), that has been acquiring key exploration projects around Canada’s largest gold mines and development projects, including Canadian Malartic Mine (Agnico Eagle), the Hemlo Mine (Barrick Gold) and the Hammond Reef Project (Agnico Eagle) (Fig. 1, 2 & 3). Upon closing, Apollo will also have approx. CDN$1.5 million in cash and no debt.

Summary of the NEW Satori:

- Name Change: The Company intends to change its name and assign a new ticker symbol.

- Treasury: Upon completion of the proposed transaction the Company will have approx. CDN$2.2 million in cash and no debt.

- Work Program: The company intends to execute the following with the proceeds from the transaction:

Tartan Lake Mine

- – Complete the first deep follow-up drill program (approx. 800 metres below surface) that will be used to expand and define the Hanging Wall Zone (“HW”) discovery made in December 2021 that intersected 23.76 gpt gold over 12.60 metres, including 47.56 gpt over 5.8 metres. This was the second-best drill intercept (grade x width) in the history of Tartan Lake. The discovery is open in all directions for further expansion.

- – Incorporate the planned deep exploration and previous drilling since 2017 (approx. 9,500 metres) into an updated NI 43-101 Resource Estimate.

- – Use the updated Resource Estimate to form the basis of a Preliminary Economic Assessment (“PEA”) study. The study will be used to estimate the capital needed to reopen the Tartan Lake Mine and returns associated with the project using and upgrading the existing infrastructure at the mine such as the ramp into the ore body, process facilities, powerlines, and access road.

- – Advance the process of updating the permits from which the Tartan Lake Mine operated under from 1986-1989 and engaging with stakeholders to design the gold mine of the future that has a minimal to no environmental impact and benefits those directly involved with the Company’s growth.

- Apollo Exploration Properties:

Malartic South Project: Located due south and adjacent to of Agnico Eagle’s Canadian Malartic Property, Malartic South offers discovery potential for both gold and copper mineralization. The property is adjacent to the Canadian Malartic’s Odyssey Underground Mine. Surface mapping indicates approximately 50% of the property is comprised of sedimentary rocks, host to a number of significant gold deposits in the region, including the Canadian Malartic deposits.

The remaining 50% of the claim block is comprised of felsic intrusive rocks that are prospective for copper mineralization as demonstrated by a series of historical exploration holes completed on an adjoining property that reported anomalous copper mineralization over an approximate 300 metre strike length. Table 1.0 presents select drill hole results from the adjoining property. Hole F96-09 is located less than 25 metres west of the Malartic South claim boundary.

Table 1.0: Selected Significant Results from Adjacent Property

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Length | From | To | Interval | Cu (%) |

| F96-09 | 715403 | 5327949 | 326 | 266 | -48 | 435.86 | 350.22 | 425.81 | 75.59 | 0.27 |

| F97-02 | 715155 | 5327891 | 310 | 360 | -90 | 391.67 | 126.16 | 193.1 | 66.94 | 0.4 |

| F97-10 | 715105 | 5327889 | 309 | 112 | -63 | 419.4 | 175.26 | 203.48 | 28.22 | 0.28 |

| F97-17 | 715304 | 5327906 | 322 | 241 | -60 | 415.75 | 230.37 | 257.98 | 27.61 | 0.35 |

Notes:

(i) All intervals are measured down hole and NOT true width. True width was not estimated due to insufficient information.

(ii) All data is excerpted from the Technical Report titled “2021 Fieldwork Report on the Malartic South Property” prepared for Eagle Ridge Mining Ltd. Dated February 16, 2022, authored by Alain-Jean Beauregard, P.Geo and Daniel Gaudreault P.Eng.

HEES Project: In 2022, limited exploration work identified historical placer mining operations on the HEES Project, which is located near Barrick Gold’s Hemlo Mine. Although early, this could be an important development as it was originally gold discovered through panning in the creek and soils that lead to the Hemlo discovery. Exploration in this area will continue during the spring and summer field seasons.

Hammond Reef North & South Projects: Located due south of Agnico Eagle’s Hammond Reef Gold Project, the Hammond Reef North and South Projects are prospective for large tonnage, low grade gold deposits. Surface rock sampling has identified anomalous results within the claim block and additional exploration work is warranted given the large resource identified to the north. The short-term objective is to prioritize exploration targets in preparation for an initial drill program.

- Board of Directors: Rob McEwen will be granted the right to appoint two board members to represent his ownership. Upon completion of the proposed transaction, Alex McEwen will join the board, with a future director to be named. Alex McEwen, the son of Rob McEwen, is co-founder and owner of Remote Power Corp., a company focused on electrifying industrial projects in mining, energy, and construction. He obtained his MBA from the University of Bradford, England.

- Management: The Company will be conducting a search for new CEO. It is intended that Jennifer Boyle, Satori’s current CEO, will remain with the Company as a member of the executive team and director.

Rob McEwen said: “High grade gold intercepts have always caught my attention, and here there are many. The new Satori will combine its advanced gold play having significant underground infrastructure situated in a mineral rich district with Apollo’s cash position and strategically located projects next to some of the largest gold mines in Canada.”

Jennifer Boyle, Chief Executive Officer of Satori, said: “This business combination with Rob McEwen ends our search to bring a new dynamic to the Company. Since refinancing Satori over the past 2 years, our small drilling campaigns intercepted grades at Tartan Lake that were not only consistent with historic drilling but resulted in some of the highest grades ever reported at the mine. Having Rob McEwen involved at this juncture is key to unlocking the potential of this project, which has been underexplored and under-funded for decades. His expertise, having realized spectacular growth during his tenure at the helm of Goldcorp Inc., and the portfolio of projects McEwen brings within Apollo, puts Satori in a competitive position for advancing mine development evaluations, and for new discoveries located on Apollo’s projects adjacent to or near to well known producing projects operated by the largest mining companies in Canada.”

Acquisition/Transaction Terms: Under the terms of a letter of intent entered into with Apollo, Satori shall issue 60,000,000 common shares to acquire all of the issued and outstanding securities of Apollo, at a deemed price of $0.05 per share. The acquisition is subject to specific conditions, including the requirement for Apollo to have not less than CDN$1,500,000 in cash, the entering into of a definitive agreement, the receipt of approval by the shareholders of Satori and Apollo, and approval of the TSX Venture Exchange. Additionally, either party failing to obtain the requisite shareholder approvals shall pay a termination fee to the other in the amount of CDN$150,000. The transaction further provides Rob McEwen with: (i) a right of first refusal on royalty or metals streaming financings offered on the Tartan Lake Gold Mine Project and the requirement for shareholder approval under prescribed conditions pertaining to such right; and (ii) a pre-emptive right to participate in future equity financings to maintain his pro rata interest, provided that such interest exceeds 20% of the outstanding shares. All shares issued to Apollo in respect of this transaction shall be subject to a hold period of four months, and to such other restrictions or escrow provisions as may be applicable. At closing of the transaction, it is anticipated that there will be 159,365,818 shares outstanding, pursuant to which McEwen will become a new control person, as that term is defined by securities legislation, holding 37.6% of the Company.

Shareholder Meeting: It is intended that an annual, general, and special meeting of shareholders will be called prior to March 31, 2023, the outside date in which applicable regulators have provided consent for an extension in which to hold the next annual meeting of shareholders. McEwen shall have the right to appoint 2 nominee directors to the board of Satori, and additionally, the board may consider a name and ticker change in conjunction with these efforts for new dynamics and branding.

Wes Hanson P.Geo., Director of Satori, is the qualified person who has reviewed and approved the contents of this press release.

ABOUT SATORI RESOURCES INC. (TSXV: BUD)

Satori is a Toronto-based mineral exploration and development company whose primary property is expanding the resource at the past producing Tartan Lake Gold Mine Project, located in the prolific Flin Flon Greenstone Belt, Manitoba.

The Tartan Lake Project (2,670 Ha.) is located approximately 12 kilometres northeast of Flin Flon, Manitoba, and includes the Tartan Lake Mine (1986-1989) which produced 36,000 ounces of gold before the mine was shut down due to, in part, the price of gold falling below USD$390. Remaining infrastructure includes: an indicated resource estimate of 240,000 ounces averaging 6.32 g/t Au (see Technical Report dated April 5, 2017 entitled “Satori Resources Tartan Lake Project Technical Report Manitoba, Canada April 2017”, prepared by Mining Plus Canada Consulting Ltd. available on www.sedar.com), an all-season access road, grid connected power supply, mill, mechanical, warehouse and office buildings, tailing impoundment and a 2,100 metre decline and developed underground mining galleries to a depth of 300 metres from surface. Gold mineralization is associated with anastomosing quartz-carbonate veins hosted in east-west striking, steeply dipping shear zones up to 30 metres in width. The veins vary from several centimetres to several metres in width and gold grades vary from 1.0 to +100 g/t. Satori believes the mineral resources of the project are currently limited by drill coverage.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jennifer Boyle, B.A., LL.B.

President and Chief Executive Officer

Satori Resources Inc.

(416) 904-2714

jennifer@capexgroupinc.com

Mr. Pete Shippen

Chair, Satori Resources Inc.

(416) 930-7711

pjs@extramedium.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of Satori contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Satori’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.